KashFlow is a cloud-based accounting software solution designed specifically for small and medium-sized businesses (SMBs). Offering a comprehensive suite of financial management tools, KashFlow has established itself as a leading choice for entrepreneurs and small business owners seeking to streamline their accounting processes.

Table of Contents

The Importance of Accounting Software for Small Businesses

In today’s fast-paced business environment, having the right accounting software can make a significant difference in the success and growth of a small business. KashFlow recognizes the unique challenges and needs of SMBs, providing a user-friendly platform that empowers them to manage their finances effectively and make data-driven decisions.

Target Audience for KashFlow

KashFlow is primarily targeted at small businesses, startups, and self-employed individuals who are looking for a straightforward, yet powerful accounting solution. The platform’s intuitive interface and focus on essential accounting features make it an attractive choice for non-accountants and business owners seeking to take control of their financial management.

Key Features & Benefits

Invoicing & Billing: Create & Send Professional Invoices

KashFlow offers a comprehensive invoicing and billing module, enabling users to create, send, and track professional-looking invoices with ease. This feature helps businesses streamline their accounts receivable processes and improve cash flow management.

Expense Tracking: Manage Expenses & Receipts

Effective expense tracking is crucial for maintaining accurate financial records and maximizing tax deductions. KashFlow provides a user-friendly interface for recording, categorizing, and managing business expenses, as well as storing and organizing digital receipts.

Bank Reconciliation: Automate Bank Feeds & Reconciliations

KashFlow simplifies the bank reconciliation process by automating bank feeds and reconciliations. This feature ensures that businesses maintain up-to-date and accurate financial records, reducing the time and effort required to manage bank transactions.

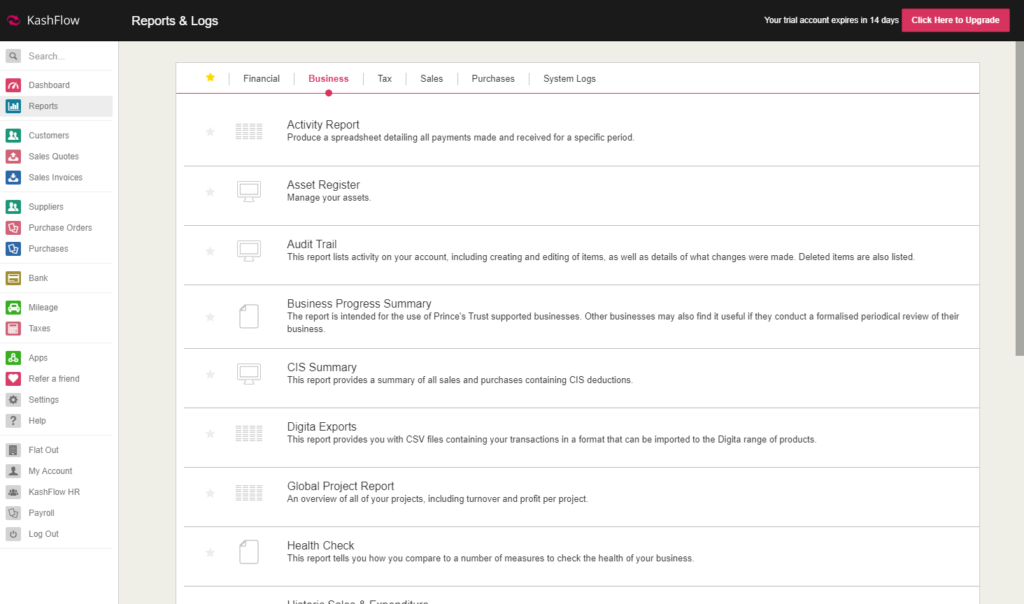

Financial Reporting: Generate Key Financial Statements (P&L, Balance Sheet, Cash Flow)

KashFlow equips users with robust reporting capabilities, allowing them to generate critical financial statements such as the Profit and Loss (P&L) report, Balance Sheet, and Cash Flow Statement. These reports provide valuable insights into the financial health and performance of the business.

Customer Relationship Management (CRM) Basics: Track Customer Information

While KashFlow is primarily an accounting software, it also offers basic customer relationship management (CRM) functionalities. Users can store and manage customer information, including contact details and invoicing history, within the platform.

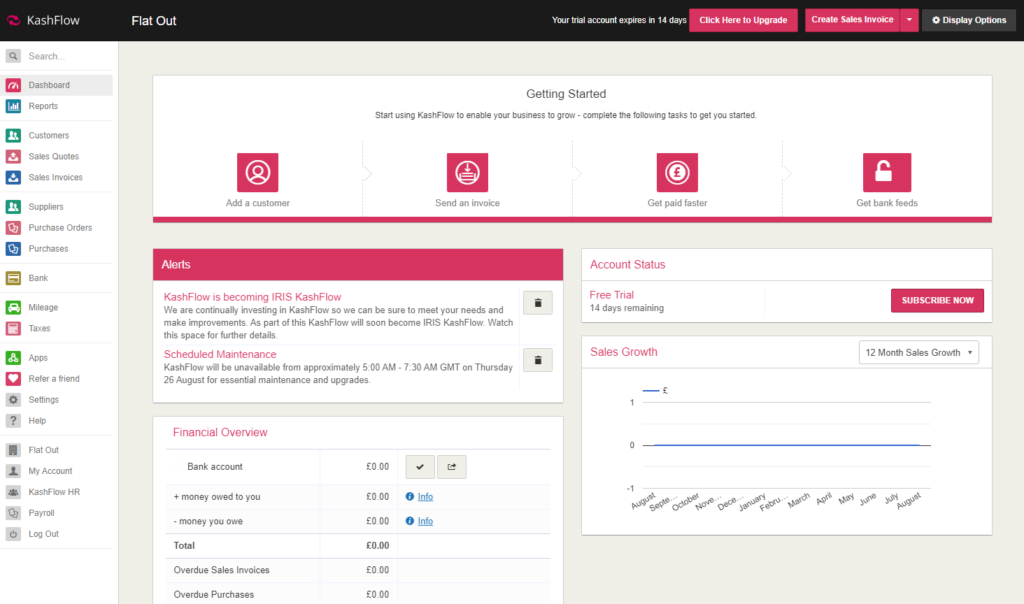

User Experience & Interface

Ease of Use: User-Friendliness for Non-Accountants

KashFlow is designed with the non-accountant small business owner in mind, offering an intuitive and user-friendly interface. The platform’s straightforward navigation and clear layout make it accessible for users of all technical backgrounds, empowering them to manage their accounting tasks with confidence.

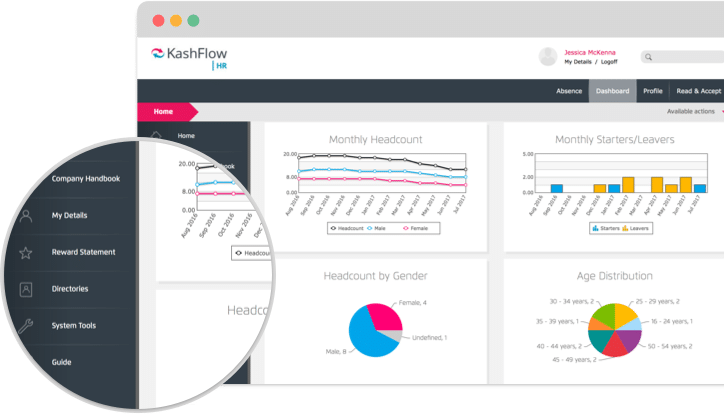

Intuitive Design & Navigation

The KashFlow interface is characterized by a clean and organized design, with clear labeling and intuitive navigation. This thoughtful approach to the user experience ensures that small business owners can quickly find the tools and features they need to streamline their financial management.

Mobile Accessibility: Managing Finances on the Go

KashFlow recognizes the importance of mobile accessibility for today’s small business owners. The platform offers a mobile-responsive experience, allowing users to access and manage their accounting data from the convenience of their smartphones or tablets, enhancing their financial management capabilities on the go.

Pricing & Plans

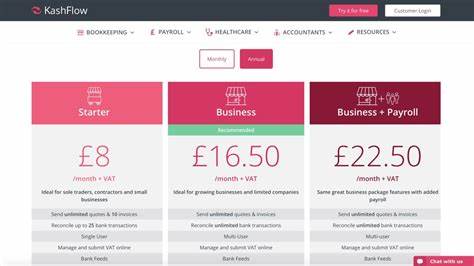

Flexible Pricing: Options to Suit Different Business Sizes

KashFlow offers a range of pricing plans, catering to the diverse needs and budgets of small businesses. From entry-level packages to more comprehensive offerings, the platform’s flexible pricing structure ensures that businesses can find a solution that aligns with their specific requirements and financial constraints.

Value for Money: Comparing KashFlow to Competitors

When compared to other accounting software solutions in the market, KashFlow often stands out for its competitive pricing and the value it provides for small businesses. The platform’s feature set and user-friendly approach make it an attractive option for cost-conscious entrepreneurs and SMBs.

Free Trial & Demos

KashFlow typically provides prospective customers with the opportunity to explore the platform through free trials or product demos. This allows small business owners to evaluate the software’s capabilities and determine if it meets their accounting and financial management needs before committing to a subscription.

Customer Support & Resources

Responsive Support Team: Getting Help When You Need It

KashFlow places a strong emphasis on customer support, offering responsive and knowledgeable assistance to users. Small business owners can access various support channels, including phone, email, and live chat, to receive timely and effective help with any questions or issues they may encounter.

Comprehensive Documentation & Tutorials

To ensure a seamless onboarding experience, KashFlow provides a wealth of online documentation, step-by-step tutorials, and educational resources. These materials empower users to learn the platform’s features and functionalities at their own pace, fostering self-sufficiency and confidence in their accounting management.

Community Forums & User Groups

In addition to the official support channels, KashFlow also fosters a vibrant community of users, allowing small business owners to connect, share experiences, and seek guidance from fellow KashFlow enthusiasts. This collaborative environment can be a valuable resource for troubleshooting, best practices, and staying up-to-date with the platform’s latest developments.

Case Studies & Testimonials

Real-World Examples of Businesses Using KashFlow

Explore the real-world impact of KashFlow through case studies and success stories from small businesses that have leveraged the platform. These examples provide valuable insights into how KashFlow has helped organizations streamline their accounting processes, improve financial decision-making, and drive overall growth.

Customer Feedback & Reviews

Delve into the customer reviews and feedback surrounding KashFlow, gaining a comprehensive understanding of the platform’s strengths, weaknesses, and overall user satisfaction. This information can help small business owners make an informed decision about whether KashFlow is the right accounting solution for their needs.

Integration with Other Tools

Bank Integrations: Seamless Bank Feed Connections

KashFlow offers seamless integration with a variety of banks and financial institutions, enabling users to automatically import and reconcile their banking transactions. This feature helps to streamline the accounting process and ensure accurate financial records.

Other Integrations: Connecting with Other Business Tools (if applicable)

In addition to bank integrations, KashFlow may also offer the ability to connect with other business tools and applications, such as e-commerce platforms or CRM systems. These integrations can help small businesses create a more cohesive and efficient operational ecosystem.

Tips for Maximizing KashFlow

Best Practices for Invoicing & Billing

Leverage KashFlow’s invoicing and billing capabilities to their fullest potential by implementing proven best practices. Learn how to create professional-looking invoices, streamline the billing process, and optimize cash flow management.

Improving Expense Tracking Efficiency

Enhance your expense tracking efficiency by utilizing KashFlow’s features and functionalities. Discover strategies for accurately recording, categorizing, and managing business expenses to ensure financial transparency and maximize tax deductions.

Leveraging Reporting & Analytics

Unlock the power of KashFlow’s reporting suite by learning how to generate and interpret key financial statements. Leverage the platform’s analytics capabilities to make data-driven decisions that drive business growth and profitability.

Limitations & Considerations

Potential Drawbacks & Limitations of KashFlow

While KashFlow offers a robust set of accounting features, it’s important to be aware of its potential limitations and drawbacks. Understand the platform’s strengths and weaknesses to ensure it aligns with your small business’s specific accounting and financial management requirements.

Features Not Available in Lower-Tiered Plans

Depending on the pricing plan you choose, certain advanced features or functionalities may not be accessible. Review the features included in each plan to determine if the lower-tiered options will meet your business’s needs or if you’ll require a more comprehensive subscription.

Security & Data Privacy

Data Security Measures & Compliance Standards

As a cloud-based accounting solution, data security and privacy are critical concerns for small businesses. Explore the measures KashFlow takes to safeguard your financial data and protect your business information, ensuring a secure and compliant environment for your accounting needs.

Protecting Your Business Information

Understand the steps KashFlow takes to protect your business-critical information, such as financial records, customer data, and sensitive documents. This knowledge can provide you with peace of mind and confidence in the platform’s ability to safeguard your company’s vital assets.

Is KashFlow Right for Your Business?

Evaluating Your Business Needs & Requirements

Before choosing KashFlow as your accounting software, carefully evaluate your small business’s specific needs, goals, and financial management requirements. This assessment will help you determine if KashFlow’s features, pricing, and overall capabilities align with your unique circumstances.

Comparing KashFlow to Other Options

When considering KashFlow, it’s essential to also explore other leading accounting software solutions in the market. Analyze the features, pricing, user experience, and customer support of KashFlow and its competitors to identify the platform that best suits your small business’s needs and budget.

The Future of KashFlow & Cloud Accounting

Emerging Trends in Accounting Software

Stay informed about the evolving landscape of accounting software and the latest trends shaping the industry. Understanding these developments can help you anticipate the future direction of KashFlow and how it may continue to adapt and improve to meet the changing needs of small businesses.

Potential Future Developments for KashFlow

Gain insights into the potential future enhancements and updates that may be in store for the KashFlow platform. This knowledge can provide you with a better understanding of the platform’s long-term roadmap and help you assess whether it aligns with your small business’s long-term financial management needs.

Get Started with KashFlow

Ready to streamline your small business finances with KashFlow Accounting Software? Visit the KashFlow website to sign up for a free trial or request a demo. Take the first step towards improved financial management, enhanced operational efficiency, and data-driven decision-making for your enterprise.

Frequently Asked Questions and Answers

Q1: Is KashFlow a cloud-based accounting solution?

A1: Yes, KashFlow is a cloud-based accounting software, allowing small businesses to access their financial data and manage their accounting tasks from anywhere with an internet connection.

Q2: What types of financial reports can I generate with KashFlow?

A2: KashFlow offers a range of financial reporting capabilities, enabling users to generate key statements such as the Profit and Loss (P&L) report, Balance Sheet, and Cash Flow Statement.

Q3: Does KashFlow offer any mobile accessibility or mobile app?

A3: Yes, KashFlow provides a mobile-responsive experience, allowing small business owners to access and manage their accounting data on the go through their smartphones or tablets.

Q4: What types of integrations does KashFlow offer?

A4: KashFlow primarily focuses on seamless bank integrations, allowing users to automatically import and reconcile their banking transactions. The platform may also offer integrations with other business tools, depending on the specific features and capabilities of the software.

Q5: How does KashFlow compare to other popular accounting software solutions like QuickBooks or Xero?

A5: When compared to competitors, KashFlow is often praised for its user-friendly interface, straightforward accounting features, and competitive pricing, making it an attractive option for small businesses with limited accounting expertise or budgets.

Conclusion

KashFlow Accounting Software has emerged as a compelling choice for small businesses seeking a reliable, user-friendly, and efficient accounting solution. By offering a comprehensive suite of essential financial management tools, the platform empowers entrepreneurs and SMBs to streamline their accounting processes, maintain accurate financial records, and make informed business decisions.

Whether you’re a startup, a growing enterprise, or a sole proprietorship, KashFlow provides a scalable and adaptable accounting platform that can cater to your evolving needs. With its intuitive interface, mobile accessibility, and responsive customer support, the software aims to simplify the financial management journey for small business owners, allowing them to focus on the core of their operations and achieve their growth objectives.

Explore the capabilities of KashFlow Accounting Software today and experience the transformative impact it can have on your small business’s financial well-being and overall success.