FreshBooks is a comprehensive cloud-based accounting software designed to simplify the financial management of small businesses and freelancers. Launched in 2003, FreshBooks has evolved into a robust and user-friendly platform that empowers entrepreneurs and professionals to streamline their invoicing, expense tracking, time management, and financial reporting processes.

Table of Contents

The Importance of Accounting Software for Small Businesses

In the dynamic landscape of small business operations, the need for reliable and efficient accounting software cannot be overstated. Effective financial management is the backbone of any successful enterprise, and FreshBooks has emerged as a game-changing solution that helps small businesses and freelancers to:

- Automate routine accounting tasks

- Improve financial visibility and decision-making

- Enhance client relationships through professional invoicing

- Ensure compliance with tax and regulatory requirements

- Save time and resources by streamlining financial workflows

Who is FreshBooks For? (Target Audience)

FreshBooks is primarily designed for small businesses, freelancers, and self-employed professionals who require a user-friendly and comprehensive accounting solution to manage their financial operations. The platform caters to a wide range of industries, including:

- Service-based businesses (e.g., consulting, marketing, IT)

- Creative professionals (e.g., graphic designers, web developers)

- Trades and construction businesses

- Personal service providers (e.g., photographers, personal trainers)

- Entrepreneurs and startups

By offering a tailored solution for these target audiences, FreshBooks empowers small businesses and independent professionals to focus on their core operations while effortlessly maintaining control over their financial health.

Key Features of FreshBooks

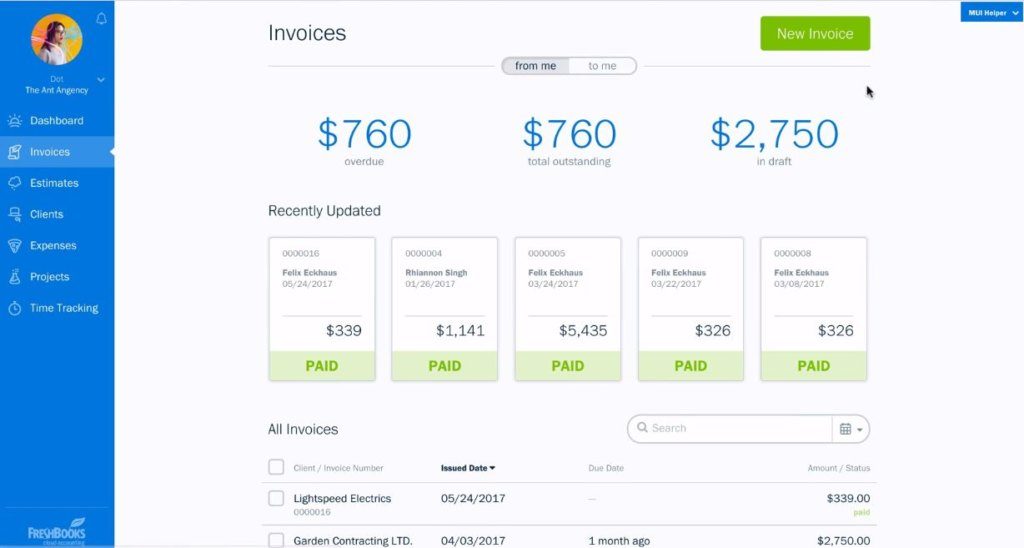

Invoicing & Billing: Create & Send Professional Invoices

At the heart of FreshBooks is its robust invoicing and billing capabilities. Users can create and customize professional-looking invoices, easily send them to clients, and track the status of outstanding payments. FreshBooks also offers features like recurring invoices, late payment reminders, and the ability to accept online payments, streamlining the entire invoicing and collection process.

Expense Tracking: Manage Expenses & Receipts

FreshBooks enables users to effortlessly track and manage their business expenses, including the ability to capture and organize receipts. This feature helps small businesses and freelancers maintain accurate financial records, streamline the tax preparation process, and gain a deeper understanding of their overall spending patterns.

Time Tracking: Track Time Spent on Projects & Clients

The FreshBooks platform includes a comprehensive time-tracking feature, allowing users to record the time spent on various projects, tasks, and clients. This data can then be seamlessly integrated into invoices, ensuring accurate billing and helping businesses better understand their resource allocation and profitability.

Payment Processing: Accept Online Payments & Manage Receipts

FreshBooks offers integrated payment processing capabilities, enabling users to accept a wide range of online payment methods, including credit cards, bank transfers, and digital wallets. This feature simplifies the payment collection process, reduces the risk of late or missed payments, and provides a streamlined receipts management system.

Financial Reporting: Generate Key Financial Statements (P&L, Balance Sheet, Cash Flow)

FreshBooks provides users with the ability to generate comprehensive financial reports, including profit and loss statements, balance sheets, and cash flow statements. These reports offer valuable insights into the financial health of a business, empowering small business owners and freelancers to make informed decisions and comply with tax and regulatory requirements.

User Experience & Interface

Intuitive Design: Ease of Use for Non-Accountants

One of the standout features of FreshBooks is its user-friendly and intuitive design, making it accessible for small business owners and professionals who may not have a strong background in accounting. The platform’s clean interface and straightforward navigation ensure a seamless experience, allowing users to quickly adapt and leverage its robust features.

User-Friendly Interface & Navigation

The FreshBooks interface is designed with the user in mind, offering a clear and organized layout that makes it easy to access the various functionalities of the platform. The navigation menu is intuitive, and the platform’s tools and features are logically grouped, enabling users to quickly find the information they need.

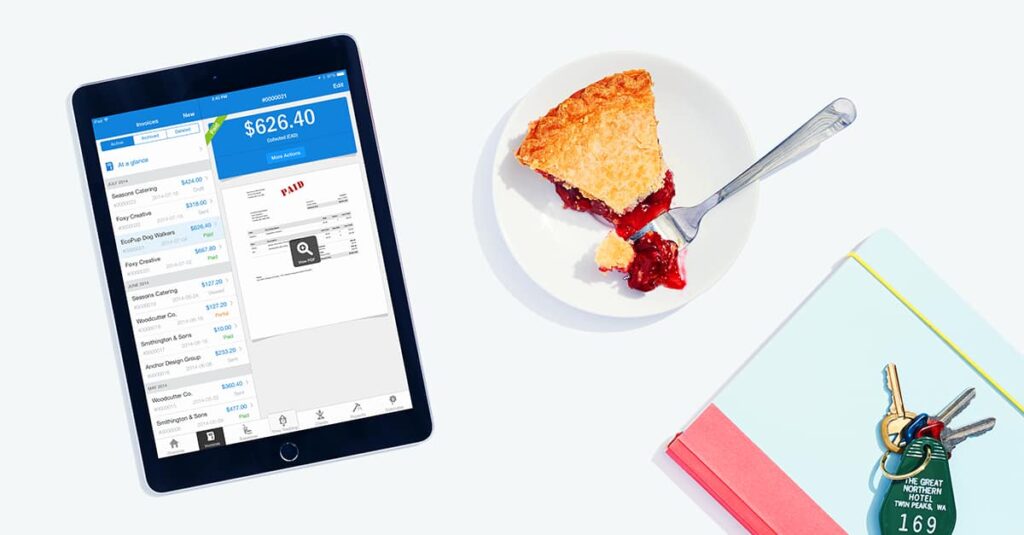

Mobile App Accessibility: Manage Finances on the Go

FreshBooks offers a mobile app, allowing users to manage their financial tasks and access critical information on the go. The mobile app mirrors the functionality of the web-based platform, ensuring a consistent user experience and enabling small business owners and freelancers to stay on top of their finances from anywhere.

Pricing & Plans

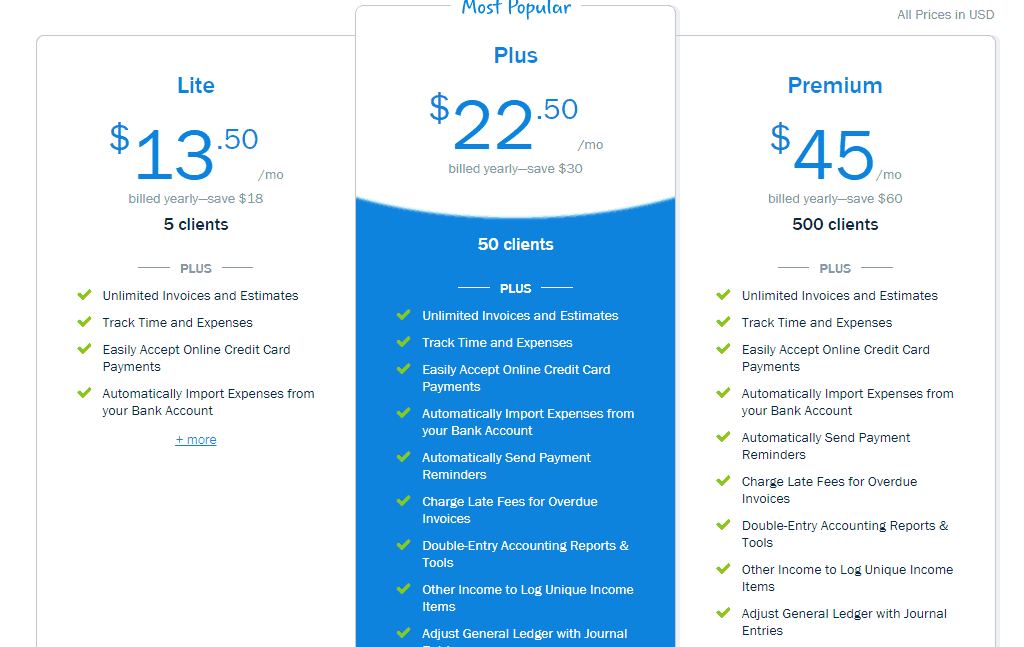

Flexible Pricing: Options to Suit Different Business Sizes

FreshBooks offers a range of pricing plans to accommodate the needs of small businesses and freelancers of various sizes. The platform’s flexible pricing structure includes a free plan, as well as several paid plans with varying feature sets and user limits, allowing users to select the plan that best fits their budget and requirements.

Free Trial: Testing FreshBooks Before Committing

FreshBooks provides a free trial period, enabling users to explore the platform’s features and functionalities before committing to a paid subscription. This allows small business owners and freelancers to assess the suitability of FreshBooks for their specific needs and ensure that it aligns with their financial management requirements.

Value for Money: Comparing FreshBooks to Competitors

When compared to other accounting software options in the market, FreshBooks is often praised for its competitive pricing and the exceptional value it offers. The platform’s comprehensive feature set, user-friendly interface, and responsive customer support make it a highly attractive choice for small businesses and freelancers seeking a reliable and cost-effective accounting solution.

Customer Support & Resources

Responsive Support Team: Getting Help When You Need It

FreshBooks places a strong emphasis on providing exceptional customer support to its users. The platform’s support team is known for its responsiveness and dedication to resolving user issues, ensuring that small business owners and freelancers can get the assistance they need to maximize the benefits of FreshBooks.

Comprehensive Documentation & Tutorials

FreshBooks offers a wealth of educational resources, including a comprehensive knowledge base, step-by-step guides, and video tutorials. These resources empower users to quickly learn the platform’s features, troubleshoot any challenges, and become proficient in leveraging FreshBooks to its fullest potential.

Community Forums & User Groups

In addition to the official support channels, FreshBooks has an active community of users who participate in online forums and user groups. These platforms serve as valuable resources for sharing best practices, exchanging ideas, and seeking peer-to-peer support, further enhancing the user experience.

Case Studies & Testimonials

Real-World Examples of Businesses Using FreshBooks

FreshBooks has helped countless small businesses and freelancers achieve their financial management goals. The platform’s case studies showcase how organizations from various industries have leveraged FreshBooks to streamline their accounting processes, improve financial visibility, and ultimately, drive the growth and success of their ventures.

Customer Feedback & Reviews

The overwhelming positive feedback and reviews from FreshBooks users highlight the platform’s impact on their businesses. Customers consistently praise the user-friendly interface, comprehensive features, and the time-saving benefits they have experienced by using FreshBooks to manage their finances.

Integration with Other Tools

CRM Integrations: Connecting with Customer Relationship Management Systems

FreshBooks seamlessly integrates with a range of popular CRM (Customer Relationship Management) platforms, enabling small businesses to streamline their customer data and financial management processes. This level of integration allows for a more holistic and efficient approach to managing client relationships and invoicing.

E-commerce Integrations: Integrating with Online Stores

For businesses with an online presence, FreshBooks offers integration capabilities with leading e-commerce platforms. This allows users to automatically sync their sales data, streamline the invoicing process, and maintain a comprehensive view of their financial performance across different sales channels.

Payment Gateway Integrations: Accepting Payments Online

FreshBooks integrates with various payment gateways, empowering small businesses and freelancers to accept online payments from their clients. This integration simplifies the payment collection process, reduces the risk of late or missed payments, and provides a seamless experience for both the business and its customers.

Tips for Maximizing FreshBooks

Best Practices for Invoicing & Billing

To get the most out of FreshBooks, users should familiarize themselves with best practices for invoicing and billing, such as creating professional-looking invoices, setting clear payment terms, and automating recurring invoices. These strategies can help small businesses and freelancers improve their cash flow and maintain strong client relationships.

Improving Expense Tracking Efficiency

By leveraging FreshBooks’ expense tracking features, users can streamline the process of managing their business expenses and receipts. This includes adopting habits like regularly logging expenses, using the mobile app to capture receipts, and organizing expenses into meaningful categories for better financial visibility.

Leveraging Reporting & Analytics

FreshBooks’ robust financial reporting capabilities can provide small business owners and freelancers with valuable insights into their financial performance. By regularly reviewing key reports, such as profit and loss statements and cash flow analyses, users can make more informed decisions, identify areas for improvement, and ensure the long-term sustainability of their business.

Limitations & Considerations

Potential Drawbacks & Limitations of FreshBooks

While FreshBooks is a powerful accounting software, it’s essential to consider potential limitations and drawbacks, such as the platform’s suitability for larger businesses with more complex financial needs, the availability of certain advanced features, and the integration capabilities with specific third-party tools.

Factors to Consider Before Choosing FreshBooks

Before committing to FreshBooks, small business owners and freelancers should carefully evaluate their specific financial management requirements, the size and complexity of their operations, and the availability of alternative accounting software options in the market. This assessment will help ensure that FreshBooks is the most suitable solution for their business needs.

Security & Data Privacy

Data Security Measures & Compliance Standards

FreshBooks places a strong emphasis on data security and privacy, ensuring that users’ sensitive financial information is protected. The platform adheres to industry-standard security protocols, data encryption, and compliance with regulations, giving small businesses and freelancers peace of mind when managing their financial data.

Protecting Your Business Information

In addition to the platform’s security measures, FreshBooks users should also be proactive in protecting their business information, including implementing strong password practices, enabling two-factor authentication, and regularly backing up their data to mitigate the risk of data loss or unauthorized access.

The Future of Small Business Accounting & FreshBooks

Emerging Trends in Accounting Software

As the small business landscape continues to evolve, the field of accounting software is also experiencing significant advancements. Trends such as increased automation, AI-powered insights, and seamless integration with other business tools are shaping the future of financial management for small businesses and freelancers.

Potential Future Developments for FreshBooks

Given FreshBooks’ commitment to innovation and its responsiveness to the changing needs of its users, it is likely that the platform will continue to enhance its features and functionalities to stay at the forefront of the accounting software industry. Potential future developments may include expanded automation capabilities, advanced analytics, and deeper integrations with complementary business tools.

Get Started with FreshBooks

To get started with FreshBooks, users can visit the platform’s website at www.freshbooks.com and click on the “Sign Up” button located in the top-right corner of the page. This will initiate the registration process, where users will be prompted to provide their basic information, such as their name, email address, and business details.

Once the registration is complete, users will be directed to the FreshBooks dashboard, where they can begin exploring the platform’s features and functionalities. FreshBooks offers a user-friendly interface, making it easy for both new and experienced users to navigate the platform and start managing their financial tasks.

Frequently Asked Questions (FAQs)

1. What is FreshBooks, and how can it benefit my small business?

FreshBooks is a comprehensive cloud-based accounting software designed specifically for small businesses and freelancers. It offers a range of features, including invoicing, expense tracking, time management, and financial reporting, to help streamline financial operations, improve cash flow, and provide valuable insights for better business decision-making.

2. Who is FreshBooks best suited for?

FreshBooks caters primarily to small businesses, freelancers, and self-employed professionals across various industries, such as service-based businesses, creative professionals, trades and construction, and personal service providers. The platform’s user-friendly interface and tailored features make it an attractive choice for non-accountants who seek a reliable and efficient accounting solution.

3. What are the key features of FreshBooks?

FreshBooks’ core features include invoicing and billing, expense tracking, time tracking, payment processing, and financial reporting. The platform also boasts a user-friendly interface, mobile app accessibility, and seamless integrations with CRM, e-commerce, and payment gateway systems.

4. How does FreshBooks’ pricing compare to other accounting software?

FreshBooks offers a flexible pricing structure with a free plan and several paid plans that cater to businesses of different sizes. The platform’s pricing is generally competitive, and it is often praised for the exceptional value it provides in terms of features and user experience compared to other accounting software options.

5. What kind of customer support and resources does FreshBooks offer?

FreshBooks is known for its responsive and dedicated customer support team, which is available to assist users with any issues or questions they may have. The platform also provides a comprehensive knowledge base, step-by-step guides, video tutorials, and an active user community to help customers maximize the benefits of the FreshBooks platform.

Conclusion

FreshBooks: The Best Accounting Software for Your Small Business

In the dynamic world of small business operations, the need for a reliable and user-friendly accounting solution has never been more critical. FreshBooks has emerged as the go-to platform for small businesses and freelancers seeking to streamline their financial management, improve their cash flow, and make more informed decisions.

With its robust invoicing, expense tracking, time management, and financial reporting capabilities, FreshBooks empowers small business owners and independent professionals to focus on their core operations, without the burden of complex accounting tasks. The platform’s intuitive interface, mobile accessibility, and seamless integrations make it an invaluable tool for organizations of all sizes.

As the small business landscape continues to evolve, the role of FreshBooks in shaping the future of accounting software is undeniable. With its commitment to innovation, exceptional customer support, and the ability to adapt to the changing needs of its users, FreshBooks remains at the forefront of the industry, providing small businesses and freelancers with the financial management tools they need to thrive.

So, if you’re a small business owner or freelancer seeking to take control of your financial operations, FreshBooks is the ultimate solution for you. Start your FreshBooks journey today and unlock the full potential of your business’s financial success.