Wave Accounting is a cloud-based financial management platform designed to cater to the needs of small businesses and freelancers. Offering a comprehensive suite of features, Wave Accounting empowers entrepreneurs and business owners to manage their finances, invoicing, expenses, and more, all from a single, intuitive interface.

Table of Contents

The Importance of Accounting Software for Small Businesses

Effective financial management is the backbone of any successful small business. Wave Accounting recognizes the unique challenges faced by small companies and provides a powerful, yet user-friendly solution to streamline their accounting processes. By leveraging the power of cloud-based technology, Wave Accounting enables small businesses to take control of their finances, improve efficiency, and make more informed decisions.

Target Audience for Wave Accounting

Wave Accounting is primarily aimed at small businesses, freelancers, and entrepreneurs who are looking for a robust, yet affordable accounting solution. The platform’s versatility and ease of use make it an attractive choice for a wide range of industries, from service-based businesses to e-commerce retailers and beyond.

Key Features and Benefits

Invoicing: Create and Send Professional Invoices

Wave Accounting’s invoicing capabilities allow users to create and send professional-looking invoices to their clients. With customizable templates, automated late payment reminders, and the ability to accept online payments, this feature helps businesses get paid faster and maintain a polished, consistent brand image.

Expense Tracking: Manage Expenses and Receipts

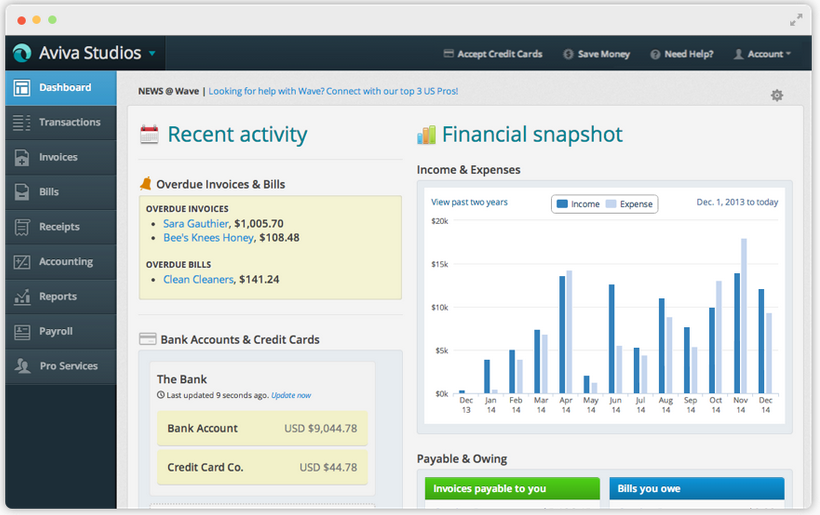

Keeping track of business expenses can be a time-consuming task, but Wave Accounting simplifies the process. Users can easily upload and categorize receipts, track mileage, and monitor their spending patterns, all from a centralized dashboard.

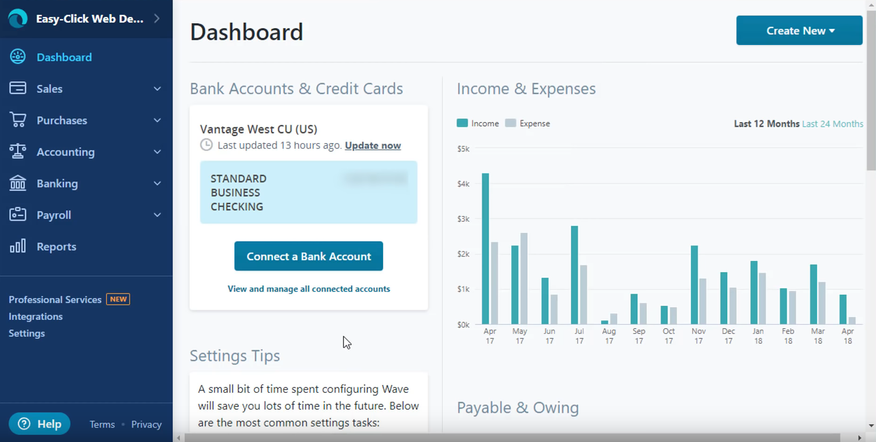

Bank Reconciliation: Automate Bank Feeds and Reconciliations

Wave Accounting seamlessly connects to users’ bank and credit card accounts, allowing for automatic synchronization of transactions. This feature streamlines the reconciliation process, reducing the time and effort required to keep financial records up-to-date.

Financial Reporting: Generate Key Financial Statements

Wave Accounting provides users with a suite of financial reporting tools, including profit and loss statements, balance sheets, and cash flow reports. These reports offer valuable insights into the financial health of the business, enabling informed decision-making.

Inventory Management: Track Inventory Levels and Sales (if applicable)

For businesses that sell physical products, Wave Accounting offers basic inventory management capabilities. Users can track inventory levels, record sales, and generate inventory-related reports, all within the platform.

User Experience and Interface

Intuitive Design: Ease of Use for All Users

Wave Accounting is known for its clean, user-friendly interface, making it accessible for business owners and employees of all technical skill levels. The platform’s intuitive design and straightforward navigation ensure a seamless accounting experience.

Mobile Accessibility: Manage Finances on the Go

Wave Accounting offers a responsive mobile experience, allowing users to access their financial data, create invoices, and manage expenses from their smartphones or tablets. This flexibility enables small business owners to stay on top of their finances anytime, anywhere.

Customization Options: Tailoring Wave to Your Needs

While Wave Accounting offers a standardized set of features, the platform also provides some customization options. Users can personalize their invoices, set custom expense categories, and adjust various settings to better suit their business needs.

Pricing and Plans

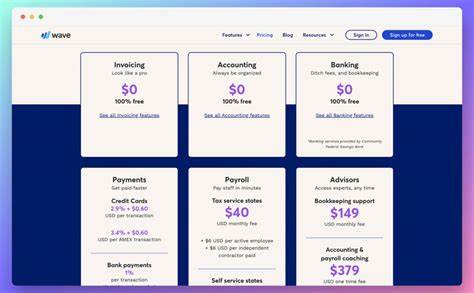

Free Plan: Access to Core Features (with Limitations)

Wave Accounting offers a free plan that provides access to the platform’s core features, including invoicing, expense tracking, and financial reporting. This plan is an excellent starting point for small businesses and freelancers who are new to accounting software.

Paid Plans: Growing Features and Functionality with Each Tier

For businesses that require additional capabilities, Wave Accounting offers several paid plans. These plans unlock more advanced features, such as income tax filing, payroll processing, and the ability to connect multiple bank accounts.

Value for Money: Comparing Wave to Competitors

When compared to other popular accounting software options, such as QuickBooks and Xero, Wave Accounting stands out for its comprehensive feature set and competitive pricing structure. The platform’s free plan, coupled with its affordable paid tiers, makes it an attractive choice for small businesses looking to optimize their financial management without breaking the bank.

Customer Support and Resources

Responsive Support Team: Getting Help When You Need It

Wave Accounting is known for its excellent customer support. Users can reach out to the support team via email, live chat, or the platform’s community forum, and receive timely and helpful responses to their questions or concerns.

Extensive Documentation and Tutorials

To help users get the most out of the platform, Wave Accounting provides a wealth of educational resources, including detailed user guides, video tutorials, and a comprehensive knowledge base. These materials cover a wide range of topics, from setting up the platform to advanced accounting techniques.

Community Forums: Connecting with Other Users

Wave Accounting encourages its users to engage with the broader community through its online forums. Here, users can share best practices, ask questions, and connect with other small business owners who are navigating the world of cloud-based accounting.

Case Studies and Testimonials

Real-World Examples: How Businesses Benefit from Wave

Wave Accounting has helped numerous small businesses and freelancers streamline their financial management and achieve greater success. Case studies showcase how the platform has enabled companies to improve cash flow, enhance invoicing processes, and gain valuable insights into their financial performance.

Customer Feedback: Positive Experiences and Success Stories

Testimonials from Wave Accounting users highlight the platform’s ease of use, comprehensive features, and positive impact on their businesses. Customers praise the platform’s ability to save them time, reduce administrative tasks, and provide a clear financial picture of their operations.

Comparison to Competitors

Wave vs. QuickBooks

While both Wave Accounting and QuickBooks are popular accounting solutions, they cater to different target audiences. Wave is primarily designed for small businesses and freelancers, offering a more simplified and cost-effective approach, while QuickBooks is better suited for larger organizations with more complex financial needs.

Wave vs. Xero

Wave Accounting and Xero share similar cloud-based architectures and feature sets, but Wave stands out for its free plan and more affordable paid tiers. Xero, on the other hand, may be better suited for businesses that require more advanced functionalities, such as project accounting or multi-currency support.

Wave vs. FreshBooks

Both Wave Accounting and FreshBooks excel at invoicing and expense management, but Wave offers a more comprehensive suite of features, including financial reporting and basic inventory tracking. FreshBooks, on the other hand, may be a better fit for service-based businesses that prioritize time tracking and project management capabilities.

Integrating Wave with Other Tools

CRM Integration: Connecting with Customer Relationship Management Systems

Wave Accounting offers integrations with popular CRM platforms, such as Salesforce and HubSpot, allowing businesses to seamlessly sync customer data and streamline their sales and accounting workflows.

E-commerce Integration: Integrating with Online Stores

For businesses with an online presence, Wave Accounting provides integrations with leading e-commerce platforms, including Shopify and WooCommerce. This enables automated synchronization of sales, inventory, and financial data, reducing manual data entry and improving overall efficiency.

Payment Gateway Integration: Accepting Payments Online

Wave Accounting seamlessly integrates with various payment gateways, including PayPal and Stripe, allowing businesses to accept online payments directly through the platform. This feature enhances the invoicing experience and improves cash flow for the company.

Limitations of Wave Accounting

Free Plan Limitations

While Wave Accounting’s free plan is an attractive offering, it does come with some limitations. Users on the free plan have access to the core features, but may be restricted in terms of the number of connected bank accounts, the ability to send invoices, and access to certain reporting functionalities.

Features Available in Paid Plans

To unlock the full suite of Wave Accounting features, businesses will need to upgrade to one of the paid plans. These plans provide access to more advanced capabilities, such as income tax filing, payroll processing, and the ability to connect multiple users to the same account.

Scalability Considerations

As a small business grows, its accounting needs may evolve. While Wave Accounting is well-suited for small businesses and freelancers, larger organizations with more complex financial requirements may eventually outgrow the platform’s capabilities and need to explore alternative solutions.

Tips for Maximizing Wave

Best Practices for Invoicing and Billing

To get the most out of Wave Accounting’s invoicing features, businesses should establish consistent invoicing processes, utilize custom templates, and leverage automated payment reminders to ensure timely payments from clients.

Improving Expense Tracking Efficiency

By diligently categorizing and recording expenses, businesses can take full advantage of Wave Accounting’s expense tracking capabilities. Encouraging employees to upload receipts promptly and maintaining accurate records can optimize this process.

Leveraging Reporting and Analytics

Regularly reviewing the financial reports and analytics provided by Wave Accounting can help business owners make more informed decisions, identify areas for improvement, and track the overall financial health of their organization.

Security and Data Privacy

Data Security Measures

Wave Accounting takes data security seriously, employing industry-standard encryption, secure servers, and regular backups to protect its users’ sensitive financial information. The platform’s commitment to data privacy and security provides peace of mind for small business owners.

Protecting Your Business Information

In addition to the platform’s security measures, users should also take proactive steps to safeguard their business data, such as implementing strong passwords, enabling two-factor authentication, and regularly reviewing access permissions.

The Future of Cloud Accounting and Wave

Emerging Trends in Accounting Software

The accounting software industry is rapidly evolving, with cloud-based platforms like Wave Accounting leading the charge. Trends such as increased automation, artificial intelligence-powered insights, and seamless integration with other business tools are shaping the future of cloud accounting.

Potential Future Developments for Wave

As Wave Accounting continues to grow and innovate, users can expect to see enhancements to the platform’s features, improvements in mobile capabilities, and the introduction of new integrations and partnerships that further streamline the financial management process.

Conclusion

Summary of Key Points: Recap the Benefits of Wave

Wave Accounting has emerged as a powerful, yet user-friendly cloud-based accounting solution for small businesses and freelancers. By offering a comprehensive suite of features, including invoicing, expense tracking, financial reporting, and more, Wave empowers its users to take control of their finances and make more informed decisions.

Is Wave Right for Your Business? A Final Verdict

Whether you’re a small startup or a thriving enterprise, Wave Accounting is worth considering as your go-to financial management platform. Its combination of robust functionality, intuitive design, and affordability make it a highly attractive option for businesses seeking to streamline their accounting processes and gain valuable insights into their financial performance.

Call to Action: Start Your Free Trial of Wave

If you’re ready to experience the benefits of Wave Accounting, visit the platform’s website (www.waveapps.com) and sign up for a free trial. Discover how this innovative cloud-based solution can transform your small business’s financial management and propel your company towards greater success.